How Much Money Can You Make After Full Retirement Age?

Cardinal Takeaways

- Working after retirement tin impact your Social Security benefits, Medicare and wellness insurance coverage, pensions and retirement accounts.

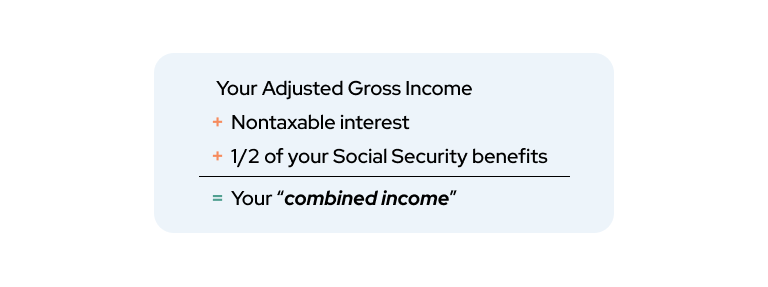

- Social Security benefits get complicated if you lot return to work and first making money. The Social Security Administration uses a term called "combined income" to determine how much of your check can exist taxed. Combined income is a combination of your adjusted gross income and nontaxable interest plus half of your yearly Social Security benefit.

- You tin can take individual health insurance and still go along your Medicare coverage if y'all render to work for an employer who offers it. Medicare can be either your master or secondary coverage.

- Returning to work later retiring may affect your pension due to certain revenue enhancement rules and conditions. If you go back to work, consider adding money to your retirement accounts.

Retirement was once a destination — a goal mail to mark the end of a long, productive career.

But enquiry indicates that retirement is becoming much more than fluid in America.

A 2017 survey from RAND Corporation, a nonprofit research business firm, constitute that almost 40 percent of workers over age 65 had previously retired — just to rejoin the workforce.

And for those still in retirement, roughly half said they would render to paid work if the right opportunity presented itself.

According to researchers: "The fact that these individuals have access to Social Security benefits and possibly other retirement income suggests they can afford to demand working conditions that more closely match their preferences in order to participate in employment."

Then, what motivates people to "unretire" or offset an encore career?

"If you're thinking near returning to work, one of ii things has happened," Accredited Fiscal Counselor Susan Greenhalgh told RetireGuide. "Yous've either been struck with a severe case of colorlessness and miss the sense of purpose working gives you lot — or you lot're feeling a financial pressure to go back, possibly due to an emergency."

Financial Considerations of Working After Retirement

Returning to work is a unique, personal decision.

Just earlier you lot head back, experts like Greenhalgh say it's essential to get a firm grasp on your current cash flow and upkeep.

"You need your optics broad open to your own financial situation," said Greenhalgh, who started her business organisation, Heed Your Money LLC, in 2018 at the age of 62. "Y'all need to be honest with yourself most your needs and your capabilities."

Did You Know?

As of Feb 2019, more than 20 percent of adults historic period 65 and older were either working or looking for work, compared with x pct in 1985.

Working in retirement can supplement your income merely it'due south important to understand what yous'll exist gaining — and potentially losing — in the procedure.

Working later retirement can impact your:

"Information technology'southward important to do a deep swoop into these things kickoff," Greenhalgh said. "Otherwise, y'all're going to be surprised at how your benefits may be impacted."

"You need your optics broad open up to your own financial situation."

If money is your primary motivator, look for jobs with wages and benefits that fill your income gaps without jeopardizing your benefits or negatively affecting your bottom line.

Y'all tin can return to work and even so collect Social Security retirement benefits.

Merely certain limits and rules must be followed.

Adrienne Ross is a financial planner in Spokane, Washington. She told RetireGuide that many people take Social Security benefits at age 62 — even if they have money saved in a retirement account.

"It oftentimes seems like a rubber, secure idea to have those benefits equally soon as possible," said Ross, founder of Clear Insight Financial Planning.

But starting Social Security when you're first eligible reduces your benefits by as much every bit 25 to 30 percentage.

"People may claim Social Security at 62 but to become back to work a few years later because they're non getting as much money in benefits as they anticipated," Ross explained.

Your age determines how much y'all tin can earn.

Social Security Full Retirement Ages

| Yr of Nativity | Full Retirement Historic period |

|---|---|

| 1955 | 66 years and ii months |

| 1956 | 66 years and 4 months |

| 1957 | 66 years and 6 months |

| 1958 | 66 years and 8 months |

| 1959 | 66 years and x month |

| 1960 and later | 67 |

In 2022, you lot tin can earn up to $19,560 without impacting your benefits before full retirement historic period.

Withal, once you hit that threshold, your Social Security cheque goes downwards $i for every $ii earned.

Did You Know?

Social Security does non include other authorities benefits, investment earnings, interest, pensions, annuities or capital gains when computing your yearly earnings limit.

For example, you lot start collecting Social Security benefits at age 62. At age 64, you get a part-time job and earn $25,000 in a year.

This is $v,440 over the limit. Your Social Security check volition be reduced by $2,720 that year — or $1 for every $2 earned.

In the twelvemonth you reach your full retirement historic period, you lot can earn upwardly to $51,960 in 2022 earlier your benefits are docked. After the $51,960 threshold, your benefits are reduced by $1 for every $3 earned.

Finally, once you lot striking your total retirement historic period, there is no cap to your income and y'all can fifty-fifty increase your Social Security benefits if you cull to continue working. Should your benefits increase, the Social Security Administration will send you a alphabetic character informing you lot of your new benefit amount.

Y'all will still continue to pay Social Security taxes on your earnings for each additional year you work.

Social Security Benefits and Taxes

If Social Security is your only source of income, you don't demand to worry about paying taxes on your benefits.

Only things get more complicated if you lot return to piece of work and start making money.

The Social Security Administration uses a term called "combined income" to make up one's mind how much of your check can exist taxed.

Combined income is a combination of your:

- Adjusted gross income (This is the amount yous get paid at work — earlier taxes are taken out — minus adjustments, such as contributions to sure retirement accounts, HSAs and other applicative deductions).

- Nontaxable interest.

- One-half of your yearly Social Security benefit.

If that combined income number is less than $25,000 for an individual, and so your Social Security benefits aren't taxable.

If your combined income is between $25,000 and $34,000 for a single filer, you lot may owe income tax on up to 50 per centum of your benefits.

If your combined income is more than than $34,000, up to 85 percent of your benefits can be taxed.

Each Jan, you'll receive a Social Security Benefit Argument, Form SSA-1099. Use this when you complete your federal return to see if yous owe taxes on your benefits.

Tip

Although y'all're not required to have Social Security withhold federal taxes, it might exist easier than paying quarterly estimated tax payments.

Social Security benefit taxation is complicated. Accomplish out to a taxation professional or financial planner if you need help.

Other Social Security Considerations

It's smarter financially to delay Social Security benefits until your total retirement historic period, Ross said.

Still, there'south a couple ways to recoup at least some of those losses.

First, if your benefits were reduced because you fabricated more than the income limits mentioned earlier, you actually get that money dorsum — eventually. It isn't gone forever.

Here'due south how it works.

Let'due south assume y'all accept Social Security at historic period 62 and receive a monthly do good of $1,000. At age 63, you lot decide to go back to piece of work.

You work for 12 months and earn more than the $19,560 income limit. Your Social Security benefits are reduced to $500 for 12 months as a result.

Once you hit total retirement age, those 12 months of reduced benefits are paid dorsum to y'all.

In this case, you'd receive your normal $one,000 monthly benefit plus $500 for 12 months.

Later on that, your do good goes back to your standard $1,000 a month.

Here'due south something else to keep in listen: Your Social Security check is based on your elevation 35 years of earnings.

If your latest year of piece of work turns out to exist ane of your highest, Social Security will refigure your monthly do good and you may see a boost in your check in one case y'all hit your full retirement historic period.

This is different than recouping your reduced benefits, and information technology likely won't affect you if y'all returned to piece of work for a low-paying or function-time job.

For more than information nearly working and Social Security benefits, check out the SSA's How Work Affects Your Benefits booklet.

Medicare, Private Insurance and Mail service-Retirement Piece of work

If you're 65 or older, you probable get health insurance from Medicare or a Medicare Advantage plan.

Original Medicare is made upward of two parts — Part A hospital insurance and Part B medical coverage. You may too choose to purchase a standalone Medicare Part D prescription drug program or a Medigap supplement insurance policy.

Most people don't pay a monthly premium for Medicare Part A. Simply near everyone pays a monthly premium for Medicare Part B. In 2022, the Part B premium is $170.x.

If you return to work for an employer who offers private wellness insurance, yous can take it and all the same keep your Medicare coverage. You're allowed to accept both.

Medicare may act as your primary coverage or your secondary coverage.

You may consider dropping Medicare Part B if you lot return to work. Some people do this to avert paying the $170.10 monthly premium in add-on to any employer health care costs.

Yet, this can be tricky. If you're non conscientious, you may owe penalties and face other issues down the road.

First, your employer must have more than than 20 employees. If that's non the case, you may exist penalized for dropping Medicare Part B.

Tip

If you have applied for or are receiving Social Security benefits, you cannot contribute to an employer health savings account, or HSA. Yous can withdraw money already in an account, merely you can't add to it.

If you have agile employer coverage, you lot can choose to disenroll from Medicare Part B.

Once you lose your employer health insurance or render to retirement, you must sign up for Part B again within 8 months.

Otherwise, y'all may face a lifetime late enrollment penalty.

Meanwhile, you but become two months to sign upwardly for a standalone Part D plan once your workplace coverage ends. You tin face a late-enrollment penalisation for this, too.

To disenroll from Medicare, y'all'll demand to submit a form, CMS-1763, and it must be completed during an interview with a Social Security representative.

Medicare Coverage for High-Income Earners

Permit's say you render to work after age 65 and keep your Medicare coverage.

If you state a lucrative second career or consulting position, you lot may enter a college income subclass and face Medicare surcharges.

That'south because, past law, high-income earners pay more for Medicare Office B and Role D.

If you're single and earn more than $91,000 only less than or equal to $114,000 a year, you must pay an additional $68.00 a calendar month for your Part B premium in 2022.

For a married couple filing jointly, extra charges start at incomes above $182,000.

A like, smaller surcharge applies to Function D premiums.

In 2022, an individual who makes between $91,000 and $114,000 a year will owe a $12.40 income-related monthly adjustment corporeality in addition to their standard Part D premium.

Pensions and Retirement Accounts

Pensions and retirement accounts are ii additional means people supplement income in later life.

Merely certain revenue enhancement rules and weather condition need to be considered if y'all're rejoining the workforce.

How Returning to Work Tin Impact Pensions

Returning to work after retiring may bear upon your pension.

Each alimony is different, so it'south of import to look at your plan'south details.

Sometimes, you must be rehired every bit a part-time or contract worker if y'all want to piece of work for your former employer and all the same receive pension benefits.

Other times, returning to work for a former employer will suspend your pension benefits.

You tin unremarkably still collect a pension and work full-time and so long every bit it'southward with a different visitor.

Bank check with your human resource section and your alimony programme provider offset to understand whatever potential penalties.

Retirement Accounts and Required Minimum Distributions

Certain retirement accounts, including 401(k)s and IRAs, follow a taxation dominion called required minimum distribution, or RMD.

This requires retirement plan business relationship owners to withdraw money starting at historic period 72.

Even if you continue working by 72, you must take a RMD from your IRA.

If you don't, you'll face a potential 50 percent tax penalty.

Did You Know?

Roth IRAs do not take RMDs and so long equally the original owner is still alive.

You might exist able to delay taking RMDs from your current employer-sponsored retirement account, such as a 401(k) or 403(b).

To delay taking 401(1000) RMDs, you must:

- Notwithstanding be working.

- Have an employer-sponsored retirement account with the business y'all work for.

- Ain less than 5 per centum of the visitor yous piece of work for.

If you get back to piece of work, consider calculation money to your retirement accounts.

A law known as the SECURE Act of 2019 makes this possible. It allows all retirees to contribute to traditional IRAs and 401(thousand)s if they earn wages.

People over historic period 50 can contribute up to $7,000 a year to an IRA. And if your company offers a 401(k) match, take it. It's substantially complimentary money.

"This can help increase your savings if you lot maybe didn't have much money in savings before returning to piece of work," Ross told RetireGuide.

Contributing to a retirement account can also help start taxes owed on your Social Security benefits considering adding money to an IRA or 401(thousand) program shrinks your adapted gross income, Ross added.

Finding the Correct Post-Retirement Job

Retirement can be a slap-up fourth dimension to pursue what yous honey and make money at the same time.

Due to the pandemic, an increasing number of part-fourth dimension jobs and side hustles tin be washed remotely at home, making them ideal for seniors.

Co-ordinate to a July 2020 research paper by Harvard University and Academy of Illinois professors, remote piece of work is near common in industries with better educated and better paid workers.

More than than a third of firms that switched employees to remote work said they call back information technology volition remain more common — fifty-fifty after the COVID-19 pandemic ends.

Online tutoring, freelance content writing and customer service positions are merely a few virtual ways older Americans tin can supplement their income.

And if you lot're not certain where to start, or need help finding a job, organizations like Goodwill Industries have expanded their online services to help people build resumes, smoothen dress etiquette and detect employment at no cost to jobseekers.

Did You Know?

During the pandemic, well-nigh 11 pct of people age 65 and older — or roughly 1.1 million people — have lost their jobs.

According to Lauren Lawson-Zilai, senior director of public relations at Goodwill Industries International, 70 pct of locations take transitioned at least some of their career services online.

"The futurity of work and skills is changing fast," Lawson-Zilai told RetireGuide. "If yous're but looking in your local classifieds for your next job, you're missing out on a big number of opportunities."

Ask an Proficient: Tips for Working After Retirement

Liz Lopez Executive Career and Business concern Coach

Liz Lopez founded her company, Obsess Your Audience Business Services, 13 years ago in Tampa Bay, Florida. She provides resume design, task search strategies, LinkedIn grooming and other services to clients who want to stand out in a competitive, 21st century job market.

1. Make money by pursuing your passions.

Think about what you want to exercise. What brings you joy in the workplace? Besides often professionals make themselves miserable considering they get later on what they think is available rather than what makes them happy.

Late career is a lousy fourth dimension to be stuck in a chore yous don't enjoy. Figure out what feels rewarding, then do the inquiry to make up one's mind what jobs or businesses align with your goals and skills.

2. Be adjustable and patient.

Encompass how things work now. The chore market place changes constantly. There is more automation, it'due south a lot less personal and it can move very slowly. By marketing yourself strategically, you lot can state an opportunity where you make a meaningful touch on and exit a valuable legacy.

3. Update your resume — and your Zoom interviewing skills.

Be prepared to develop a resume, cover alphabetic character and LinkedIn profile that aligns with current job marketplace trends. Then learn how to interview effectively via video. You demand to powerfully show that you are relevant in today'due south world.

four. Play up your recent work history.

Focus on your history and achievements from the last ten to 15 years. Otherwise, you tin age yourself out of consideration if you insist on talking nigh piece of work yous did thirty years ago. Ageism is sadly very existent.

5. Consider speaking with a professional person.

If you are not sure how to get started, find a career coach experienced with mature and tardily-career professionals. Whichever route y'all have, consult with your accountant or revenue enhancement professional to sympathize the impact of whatsoever new income.

Additional Resources

- CareerOneStop

- CareerOneStop is a comprehensive career, training and job search website sponsored by the U.S. Department of Labor. It offers many free online tools, including a job lath, manufactures, grooming resources and more than. You can also discover local aid by entering your city or naught code into the American Job Eye finder on the website.

- Goodwill Industries

- Local Goodwill employment specialists tin can provide a alloy of in-person and virtual services, classes and training programs in various fields. They also offer resume assistance and virtual chore fairs. Telephone call i-800-466-3945 or visit goodwill.org to search for your local Goodwill past zip lawmaking.

- Senior Community Service Employment Program

- The Senior Community Service Employment Plan connects low-income, unemployed adults age 55 and older with customs service work at nonprofit and public facilities, such as schools, hospitals and senior centers. Participants piece of work an average of xx hours a week at minimum wage and are provided gratuitous preparation as a bridge to unsubsidized employment. For more information, telephone call 1-877-872-5627, or visit the online Older Worker Program Finder.

- WorkForce50.com

- Launched in 2007, WorkForce50.com allows mature workers to browse a wide range of job postings and explore companies specifically interested in hiring older employees. The website also features an all-encompassing library of manufactures on relevant career topics.

Final Modified: May 6, 2022

25 Cited Research Manufactures

- Centers for Medicare & Medicaid Services. (2020, Nov 6). 2021 Medicare Parts A & B Premiums and Deductibles. Retrieved from https://www.cms.gov/newsroom/fact-sheets/2021-medicare-parts-b-premiums-and-deductibles

- HBS Working Knowledge. (2020, October 15). How Much Will Remote Piece of work Continue After The Pandemic? Retrieved from https://www.forbes.com/sites/hbsworkingknowledge/2020/10/15/how-much-will-remote-work-continue-later-the-pandemic/?sh=a1d40e310a97

- Jacobson, K., Feder, J. and Radley, D. (2020, October half-dozen). COVID-19's Impact on Older Workers: Employment, Income, and Medicare Spending. Retrieved from https://www.commonwealthfund.org/publications/issue-briefs/2020/oct/covid-19-impact-older-workers-employment-income-medicare

- Internal Revenue Service. (2020, September 23). Retirement Topics — Required Minimum Distributions (RMDs). Retrieved from https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-required-minimum-distributions-rmds

- Internal Acquirement Service. (2020, September 19). Retirement Plan and IRA Required Minimum Distributions FAQs. Retrieved from https://www.irs.gov/retirement-plans/retirement-plans-faqs-regarding-required-minimum-distributions#1

- Bartik, A., Cullen, Z., Glaeser, E., et al. (2020, July 29). What Jobs Are Being Done at Home During the COVID-19 Crisis? Testify from House-Level Surveys. Retrieved from https://hbswk.hbs.edu/item/what-jobs-are-being-done-calm-during-the-covid-19-crisis-evidence-from-house-level-surveys

- Rapacon, Due south. (2020, June 18). How Older Adults Can Detect Work-at-Dwelling Jobs During the Pandemic. Retrieved from https://world wide web.aarp.org/work/task-search/finding-work-from-home-jobs/

- Internal Revenue Service. (2020, February eighteen). Publication 969 2019 Wellness Savings Accounts and Other Tax-Favored Health Plans. Retrieved from https://www.irs.gov/publications/p969#en_US_2019_publink1000204138

- Social Security Administration. (2020). Fact Sheet: 2021 Changes to Social Security. Retrieved from https://www.ssa.gov/news/press/factsheets/colafacts2021.pdf

- Social Security Assistants. (2020). How Work Affects Your Benefits. Retrieved from https://www.ssa.gov/pubs/EN-05-10069.pdf

- Social Security Administration. (2020). Retirement Benefits. Retrieved from https://www.ssa.gov/pubs/EN-05-10035.pdf

- O'Brien, S. (2019, Baronial 12). Dropping Medicare for employer health coverage may trip you up. Retrieved from https://www.cnbc.com/2019/08/12/dropping-medicare-for-employer-health-coverage-may-trip-yous-up.html

- United Income. (2019, Apr 27). Older Americans in the Workforce. Retrieved from https://unitedincome.capitalone.com/library/older-americans-in-the-workforce

- Edleson, H. (2019, April 22). More Americans Working Past 65. Retrieved from https://www.aarp.org/work/employers/americans-working-past-65/

- Edleson, H. (2018, September 12). Working After Retirement: Beware the Cost. Retrieved from https://www.aarp.org/retirement/planning-for-retirement/info-2018/going-back-to-piece of work-ss.html

- O'Brien, S. (2018, August thirteen). How part-fourth dimension work in retirement tin affect Social Security taxes and Medicare costs. Retrieved from https://www.cnbc.com/2018/08/xiii/part-time-work-in-retirement-tin-bear upon-social-security-and-medicare.html

- Bridge, P. (2018, March thirty). Many Americans Endeavor Retirement, Then Change Their Minds. Retrieved from https://www.nytimes.com/2018/03/30/wellness/unretirement-work-seniors.html

- Maestas, N., Mullen, Grand., Powell, D., et al. (2017). Working Conditions in the United States: Results of the 2015 American Working Weather Survey. Retrieved from https://world wide web.rand.org/pubs/research_reports/RR2014.html

- Barry, P. (2014, April). Disenrolling from Part B. Retrieved from https://www.aarp.org/health/medicare-insurance/info-05-2008/ask_ms__medicare_5.html

- CareerOneStop.org. (n.d.). Older worker. Retrieved from https://www.careeronestop.org/ResourcesFor/OlderWorker/older-worker.aspx

- Centers for Medicare & Medicaid Services. (northward.d.). Medicare Decisions for Those Over 65 and Planning to Retire in the Adjacent 6 Months. Retrieved from https://www.cms.gov/Outreach-and-Education/Find-Your-Provider-Type/Employers-and-Unions/FS4-Medicare-for-people-over-65-nearing-retirment.pdf

- Medicare.gov. (n.d.). How Medicare works with other insurance. Retrieved from https://www.medicare.gov/supplements-other-insurance/how-medicare-works-with-other-insurance

- Centers for Medicare & Medicaid Services. (n.d.). 2022 Medicare Parts A & B Premiums and Deductibles/2022 Medicare Part D Income-Related Monthly Aligning Amounts. Retrieved from https://world wide web.cms.gov/newsroom/fact-sheets/2022-medicare-parts-b-premiums-and-deductibles2022-medicare-office-d-income-related-monthly-aligning

- Social Security Administration. (north.d.). Do good Calculators. Retrieved from https://www.ssa.gov/benefits/calculators/

- Social Security Administration. (n.d.). Income Taxes And Your Social Security Do good. Retrieved from https://www.ssa.gov/benefits/retirement/planner/taxes.html

Source: https://www.retireguide.com/guides/working-after-retirement/

Posted by: yamadacouren.blogspot.com

0 Response to "How Much Money Can You Make After Full Retirement Age?"

Post a Comment