How To Make Money By Selling Call Options

What is a Call Pick?

A phone call option, commonly referred to as a "call," is a grade of a derivatives contract that gives the call option buyer the correct, but not the obligation, to buy a stock or other fiscal instrument at a specific price – the strike price of the pick – within a specified time frame. The seller of the choice is obligated to sell the security to the buyer if the latter decides to practise their selection to make a purchase. The buyer of the option can exercise the option at any fourth dimension prior to a specified expiration engagement. The expiration engagement may be iii months, six months, or even 1 yr in the future.

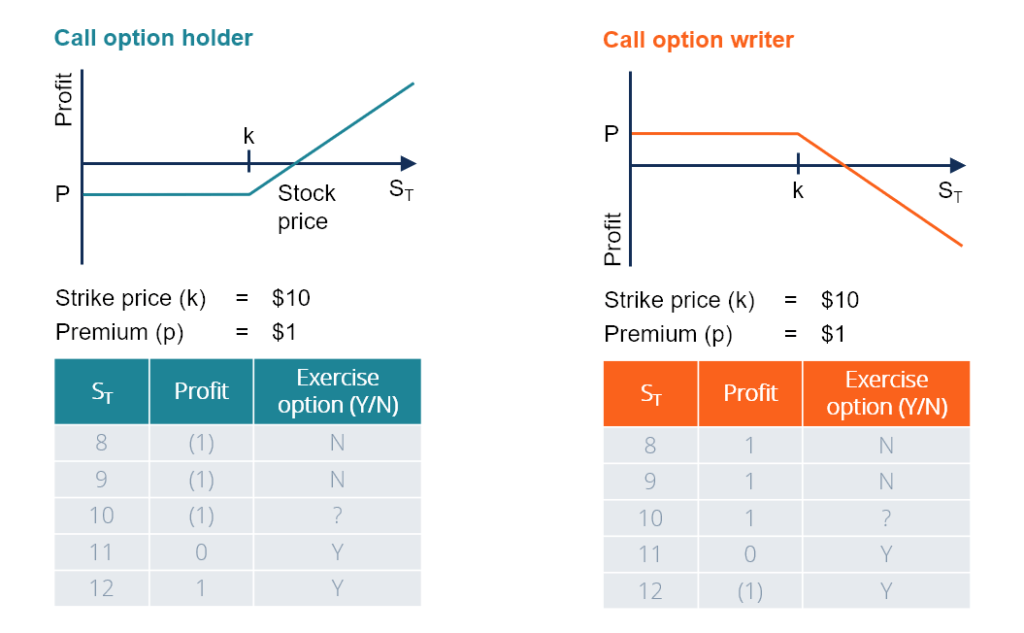

The seller receives the purchase price for the pick, which is based on how close the option strike price is to the price of the underlying security at the fourth dimension the option is purchased, and on how long a menstruum of time remains till the option's expiration engagement. In other words, the price of the selection is based on how probable, or unlikely, it is that the selection heir-apparent will take a adventure to profitably practise the option prior to expiration. Ordinarily, options are sold in lots of 100 shares. The buyer of a call option seeks to make a turn a profit if and when the toll of the underlying nugget increases to a price higher than the option strike toll.

On the other manus, the seller of the call option hopes that the cost of the asset will refuse, or at least never rise as high as the option strike/practise price earlier it expires, in which case the money received for selling the option will be pure turn a profit.

If the price of the underlying security does non increase across the strike toll prior to expiration, then it volition not be profitable for the option buyer to exercise the pick, and the option will expire worthless or "out-of-the-money." The buyer will suffer a loss equal to the price paid for the call choice. Alternatively, if the cost of the underlying security rises to a higher place the option strike price, the buyer can profitably exercise the option.

For case, assume yous bought an option on 100 shares of a stock, with an pick strike price of $xxx. Before your option expires, the price of the stock rises from $28 to $xl. So you could exercise your right to buy 100 shares of the stock at $30, immediately giving you a $x per share profit.

Your net profit would be 100 shares, times $10 a share, minus whatever purchase price you paid for the option. In this example, if you had paid $200 for the phone call choice, and then your net profit would be $800 (100 shares x $10 per share – $200 = $800).

Buying call options enables investors to invest a modest amount of capital to potentially profit from a price rise in the underlying security, or to hedge away from positional risks . Small investors use options to try to turn pocket-size amounts of money into large profits, while corporate and institutional investors use options to increment their marginal revenues and hedge their stock portfolios.

How Exercise Call Options Work?

Since call options are derivative instruments, their prices are derived from the price of an underlying security, such every bit a stock. For example, if a buyer purchases the call choice of ABC at a strike toll of $100 and with an expiration date of December 31, they will have the correct to purchase 100 shares of the company whatsoever fourth dimension before or on December 31.

The buyer can also sell the options contract to another option buyer at whatever time before the expiration appointment, at the prevailing market cost of the contract. If the price of the underlying security remains relatively unchanged or declines, then the value of the pick will decline as it nears its expiration appointment.

Investors use call options for the following purposes:

i. Speculation

Call options permit their holders to potentially gain profits from a price ascension in an underlying stock while paying only a fraction of the toll of ownership actual stock shares. They are a leveraged investment that offers potentially unlimited profits and express losses (the toll paid for the choice). Due to the loftier degree of leverage, call options are considered high-risk investments.

2. Hedging

Investment banks and other institutions employ phone call options equally hedging instruments. Simply similar insurance, hedging with an option opposite your position helps to limit the amount of losses on the underlying instrument should an unforeseen event occur. Call options can be bought and used to hedge short stock portfolios, or sold to hedge against a pullback in long stock portfolios.

Buying a Call Choice

The buyer of a call option is referred to as a holder. The holder purchases a call choice with the hope that the price volition rise beyond the strike price and before the expiration engagement. The profit earned equals the sale gain, minus strike cost, premium, and whatever transactional fees associated with the sale. If the price does not increment beyond the strike toll, the heir-apparent volition non exercise the option. The buyer will suffer a loss equal to the premium of the call option.

For case, suppose ABC Company's stock is selling at $40 and a call option contract with a strike toll of $40 and an decease of one month is priced at $ii. The buyer is optimistic that the stock toll will rise and pays $200 for one ABC call option with a strike price of $forty. If the stock of ABC increases from $xl to $50, the heir-apparent volition receive a gross profit of $1000 and a net turn a profit of $800.

Selling a Call Selection

Call option sellers, besides known equally writers, sell telephone call options with the hope that they become worthless at the expiry date. They brand money by pocketing the premiums (toll) paid to them. Their profit volition be reduced, or may even result in a net loss if the pick buyer exercises their choice profitably when the underlying security cost rises in a higher place the option strike toll. Call options are sold in the following two ways:

1. Covered Call Pick

A call choice is covered if the seller of the phone call option really owns the underlying stock. Selling the telephone call options on these underlying stocks results in additional income, and will offset any expected declines in the stock price. The pick seller is "covered" against a loss since in the outcome that the option buyer exercises their option, the seller tin provide the heir-apparent with shares of the stock that he has already purchased at a cost below the strike price of the option. The seller's profit in owning the underlying stock will exist limited to the stock'south rise to the option strike cost only he will be protected confronting whatever actual loss.

2. Naked Call Option

A naked call option is when an option seller sells a telephone call option without owning the underlying stock. Naked short selling of options is considered very risky since there is no limit to how high a stock's toll tin can go and the option seller is not "covered" against potential losses by owning the underlying stock.

When a call option heir-apparent exercises his right, the naked option seller is obligated to buy the stock at the current marketplace price to provide the shares to the option holder. If the stock price exceeds the call option'due south strike price, so the difference between the current market price and the strike price represents the loss to the seller. Well-nigh option sellers accuse a high fee to compensate for whatever losses that may occur.

Call Choice vs. Put Option

A call option and put option are the opposite of each other. A telephone call option is the right to buy an underlying stock at a predetermined price upwardly until a specified expiration date. On the contrary, a put pick is the correct to sell the underlying stock at a predetermined toll until a fixed expiry date. While a call selection buyer has the right (but not obligation) to purchase shares at the strike price earlier or on the death date, a put pick buyer has the right to sell shares at the strike price.

Related Readings

Thank you for reading CFI's guide on Call Options. To continue developing your career as a fiscal professional person, check out the post-obit additional CFI resources:

- Types of Markets – Dealers, Brokers and Exchanges

- Long and Brusque Positions

- Options Case Study

- Buying on Margins

Source: https://corporatefinanceinstitute.com/resources/knowledge/trading-investing/call-option/

Posted by: yamadacouren.blogspot.com

0 Response to "How To Make Money By Selling Call Options"

Post a Comment